Financing the defence industry: toward a new approach to compliance by banks

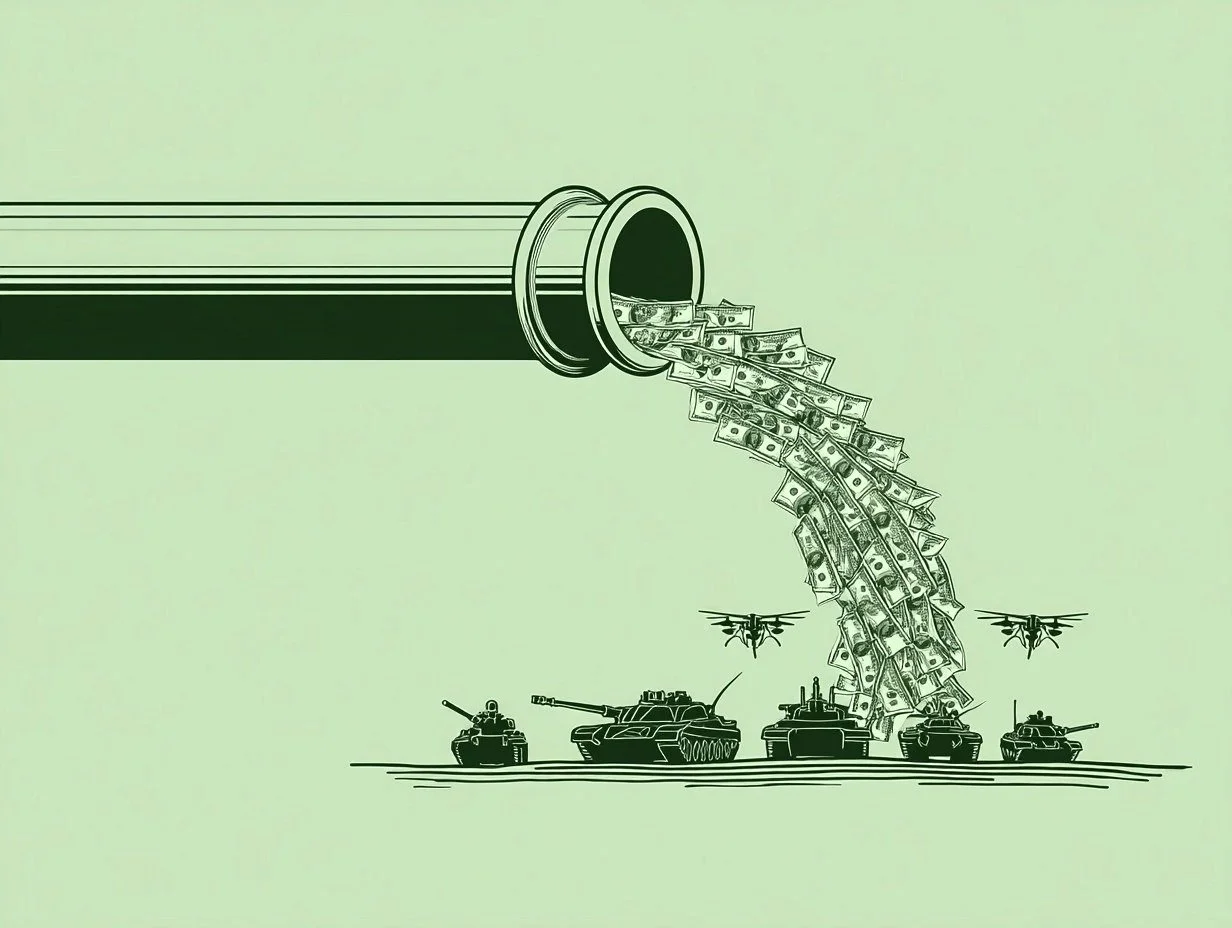

Amid rising geopolitical tensions and the return of sovereignty-driven policies, banks are redefining their approach to defence financing. Compliance, once focused on risk prevention and ESG criteria, is now evolving to align with the strategic priorities of states.

1. Prudence long upheld as a principle

Shaped by sanctions regimes, international commitments, and the rise of ESG criteria, banking compliance has long approached the defence sector through a logic of heightened vigilance. Many banks chose to exercise caution by partially, or even entirely, excluding defence companies from their financing portfolios.

This orientation reflected an institutional rationale: reducing exposure to reputational risk, avoiding legal grey areas linked to sensitive exports, and preserving consistency between public commitments to responsible finance and the day-to-day practice of credit. In most internal policies, the defence sector was treated as a high-risk category, at the crossroads of ethical, political, and regulatory considerations.

This long-dominant approach steered financing policies toward a prudent management of risk, even as the defence industry’s investment needs grew under the combined effects of geopolitical tensions and equipment-modernisation programmes. Driven by successive crises and the reaffirmation of economic-sovereignty policies, this orientation has gradually been reassessed.

2. A shift in banking doctrine

The geopolitical upheavals of recent years have profoundly altered how economic actors conceive of security. The return of war to the European continent, growing tensions in Asia and the Middle East, and the fragmentation of strategic supply chains have all placed defence back at the centre of resilience policies.

At the same time, the intensifying economic rivalry between the United States and China has resulted in a series of restrictive trade measures, technological controls, and export limitations. These dynamics, by reshaping the geography of trade and production, have led states to reconsider their degree of strategic autonomy and their industrial dependencies.

In this new environment, the compliance frameworks developed over the past two decades are showing their limits. Designed in a context of stability and economic integration, they were largely based on ESG considerations suited to a globalised economy. The growing tensions between major powers, the rise of export restrictions, and the redefinition of industrial policies are now shifting these balances: compliance is increasingly called upon to serve objectives linked to security, sovereignty, and state resilience.

These developments have led financial institutions to reassess their positioning vis-à-vis the defence sector.

As reported by the Financial Times, BNP Paribas recently revised its defence-sector financing policy, abandoning the broad concept of “controversial weapons” in favour of a more precise definition limited to armaments prohibited under international treaties. This clarification illustrates how banking actors are adjusting their internal frameworks in line with states’ strategic priorities.

Other developments confirm this shift: the decision by several funds, including BlackRock, to withdraw from the Net Zero Asset Managers initiative in January 2025 already reflected growing tensions between financial institutions’ climate commitments and the economic and political imperatives of their home states. Meanwhile, on 14 October, JPMorgan announced a major investment programme in industries deemed essential to U.S. national security.

Taken together, these developments point to a structural trend: financial institutions, long focused on climate and social compliance, are now bringing issues of sovereignty, industrial resilience, and security back into their core analytical and financing criteria.

3. The evolving role of compliance

Beyond their immediate context, these developments reveal a deeper transformation of compliance itself. It has never been independent from the political priorities that shape it. In periods of calm, compliance reflects ambitions of openness, sustainability, and transparency. But when state rivalries intensify, it mirrors other priorities, including those of stability, security, and sovereignty.

ESG criteria no longer occupy the primary place. Compliance has become an instrument for aligning public-policy objectives with present constraints: export controls, supervision of sensitive technologies, and the securing of strategic supply chains. It remains grounded in vigilance and respect for the law but shifts its centre of gravity: from a normative compliance focused on risk prevention to a functional compliance aligned with collective-security imperatives.

4. Implications for the defence industry

For companies within the Defence Industrial and Technological Base (BITD), this evolution is reshaping the terms of dialogue with financial institutions. Access to credit remains regulated, but it now relies on clearer evaluation criteria and an enhanced ability to demonstrate the robustness of internal compliance mechanisms.

Companies must be able to document their export-control processes, substantiate their due-diligence checks on business partners, ensure consistency between contractual commitments and applicable regulations, and demonstrate effective control over their supply chains. In this configuration, compliance becomes a vector of economic legitimacy: it conditions not only access to financing but also the quality and continuity of banking relationships over time.

This evolution may also foster greater mutual understanding between defence companies and financial institutions. Increased transparency, the standardisation of compliance documentation, and the adoption of shared due-diligence procedures constitute levers for rebuilding trust and streamlining financing channels.

5. A gradual convergence between finance and security

The revision of BNP Paribas’s policy, BlackRock’s repositioning, and JPMorgan’s initiative all reflect a single movement: a rebalancing between compliance requirements, financial responsibility, and strategic considerations. Banks are not renouncing their duty of vigilance; they are redefining its parameters in light of a profoundly transformed international environment.

This shift, still in the process of consolidation, signals a lasting evolution. Compliance is no longer merely a tool for protection against legal risk but a framework linking finance, sovereignty, and security. As financial institutions adapt their internal doctrines, a new phase is emerging in the dialogue between the banking sector, public authorities, and the defence industry: a dialogue founded on the search for balance between responsibility, stability, and the continuity of collective capabilities.

The boundary between finance and security is gradually fading, giving way to a shared imperative: ensuring the continuity of collective capabilities in an increasingly uncertain strategic environment.